Businesses are often tasked with “optimizing” prices across their product set or service portfolio. One of the most challenging parts of this assignment is fully defining what “optimize” truly means. This can take on a variety of forms such as:

- Maximize revenue

- Improve profit margins

- Increase purchase volume (frequency and/or order size)

- Drive growth and usage (reaching new customers and growing the existing base)

- Synergize the price of a new service or offering with the existing portfolio

To make matters even more difficult, the objective is likely more complex than any one of these in isolation. Consider the following example goal for pricing “optimization”:

Optimize pricing to maximize revenue and profit margins while limiting the risk to growth and overall brand perceptions.

Every business will have unique objectives for pricing strategy. Once these are fully defined, the roadmap to uncover an “optimal” portfolio pricing strategy can begin. Our focus today is the optimization of pricing once a customer has decided to buy from your brand (of course, pricing also plays a pivotal role in the brand-level decision; a separate approach is needed to understand that role and what it means for the business).

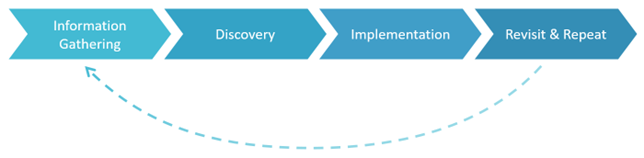

Pricing Optimization Roadmap

Information Gathering

This phase includes gathering information on the current state of the market, pricing and usage across the portfolio, and any other data that plays a role in the purchase decision (this may be internal or external data providing insights around the market as a whole). Testing the full portfolio of available products is typically not feasible. Thus, this information can be used to create a representative set of products or services that account for a majority of the business, and will ultimately drive the pricing structure for the portfolio. Including all available portfolio data may seem necessary, but too much information can divert attention from important tasks.

Discovery

The discovery phase of pricing research is built around observing the impact of price changes on the actual purchase decision. The approaches used in this phase can vary widely based on the objectives, types of products and services, and the control that the pricing team has on the overall business. It is important to take a holistic approach during the discovery phase that includes the following:

Primary research

There are a few pricing techniques to choose from when considering a survey. Some of the more basic and budget friendly approaches (Gabor Granger, Van Westendorp) are simple to execute, but have well known pitfalls when it comes to establishing a real-world purchase scenario. Advanced methods under the conjoint umbrella, and results from these techniques, have been shown to closely reflect more realistic trade-offs that are part of purchase decisions. Pricing research naturally lends itself to conjoint (choice-based or menu-based) and is often the optimal approach for addressing pricing objectives.

Combining new insights with other data sources

While primary research is an excellent method to formally test the impact of pricing changes on a portfolio, it should not be the only piece of information leveraged. A close review of historic data will also shed light on reactions to price changes. Linking these two sources together, along with other pertinent information (e.g., competitive tendencies, psychological pricing thresholds, etc.), provides the widest lens to inform strategic pricing decisions. Essentially, use the new research to come up with potential action plans, and look back to previous pricing actions for additional insight into market reactions before executing any particular plan.

In-market testing

A comparison of the impact of pricing changes on two sets of similar customer groups is a great way to confirm the pricing strategy is effective. It is an integral step to any pricing optimization process and can build confidence in research findings or prevent a risky price change. If possible, test each price change in a controlled setting to validate before proceeding to implementation. This could be testing the changes for a set amount of time, in a certain market, or in a certain location type or channel – any of which done in parallel with a similar control group as a benchmark for effectiveness.

Implementation

When it is time to roll out portfolio price changes, proceed with caution and keep a few things in mind:

- Start with what tested well throughout the discovery phase (this often means the least disruptive set of items and not always the ones with the highest return)

- If sales volume retention of the entire portfolio is important, gradually increase prices over time instead of all at once as long as price increases tested well

- If volume shifts from a portion of the portfolio are the main objective, larger price changes may be appropriate

- Implement marketing campaigns to drive awareness if prices are decreased

- Short term gains are likely to change as customers become aware of the new pricing structure

It is important to monitor sales data while rolling out new prices to validate that the research findings have the desired real word impact across the full customer base.

Revisit & Repeat

Successful pricing strategies are an essential component of any product market plan to stay relevant over time. Results from a well-designed optimization exercise can remain valid for 12-18 months. During this time, it is important to make updates to any advanced analysis or mathematical models as the market adjusts to the new pricing structure. Updating findings and recommendations are ongoing processes that take place throughout the rollout and until new research is conducted. Be aware that abrupt changes to the market (COVID-19 is a perfect example), may require you to re-examine your 12-18 month recommendations and conduct research sooner than planned to understand the impact on purchase intent.

As a final point, remember, customers do not typically view a given brand’s pricing in a vacuum. Strategies that leverage research findings to incorporate competitive pricing implications in pricing your products effectively will be covered in an upcoming article.