The Business Issue

Several years ago a major pharmaceutical company launched a new drug they expected to be a blockbuster, as it offered efficacy advantages over the current drugs in the treatment class. It turned out, however, to be a failure as the new drug’s market share fell far short of expectations.

Few events are more disturbing to a company than when a highly touted new product fails to reach the expected market share. The marketing people blame the product development group for creating a flawed product while the product group points the finger at the marketing people for failing to educate the target about the true value of the product.

Diagnosing the Issue

When a newly introduced product fails to live up to expectations there is a way to determine not only what the problem is, but more importantly what can be done to correct it. The answer can be found in a variation of discrete choice modeling that is used after a new product has been in the market long enough to establish its likely market share. This variation can be used to determine whether a new product has failed because it is misperceived by the market or because it provides advantages that the target doesn’t really care about.

The Approach

Post-Introduction Modeling uses a three-stage approach:

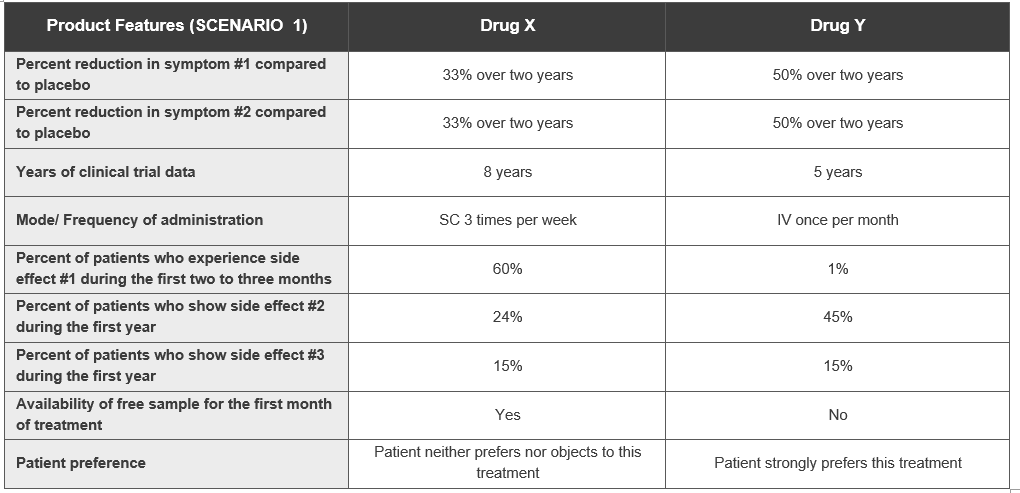

Stage 1 – In this stage, respondents (in this case physicians) go through a series of scenarios and choose between hypothetical drug descriptions, thereby revealing the value of each attribute in the prescription decision.

Hypothetical Product Scenario

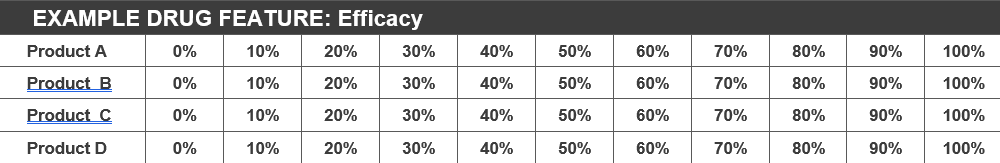

Stage 2 – In this next stage, each respondent selects the percentage that he or she believes is closest to the actual value for each feature, revealing his or her perception of each product. In the following example, physicians indicate their beliefs about the efficacy levels of each product.

Efficacy Attribute Perceptions

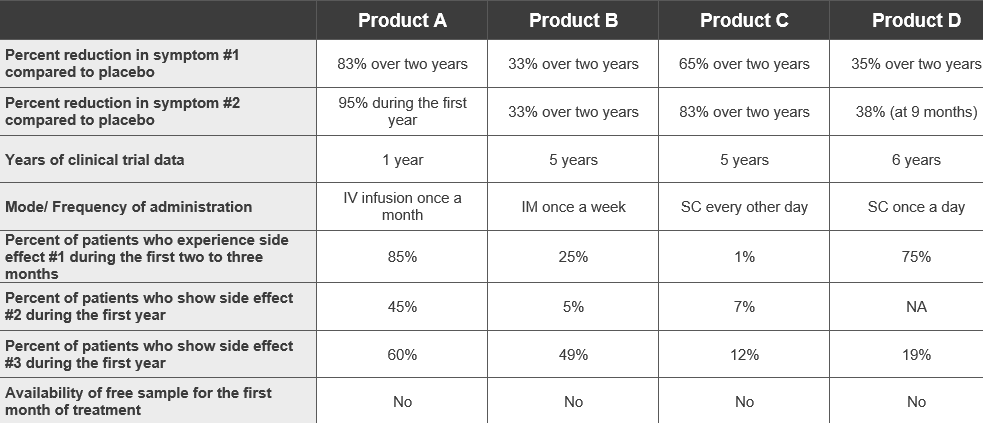

Current Market Assessment

Stage 3 – In the final stage each respondent indicates the likely prescription levels for existing products after being shown the actual attribute levels for all products, allowing us to assess the impact on behavior of enhancing knowledge through a marketing campaign.

Interpreting the Results

After collecting this data we develop a model which combines the impact of key attributes with the values associated with each of the products in the market. This allows us to model both shares based on perceptions and shares based on actual values. This provides both diagnostics and an answer to the original question of why the shares have fallen short.

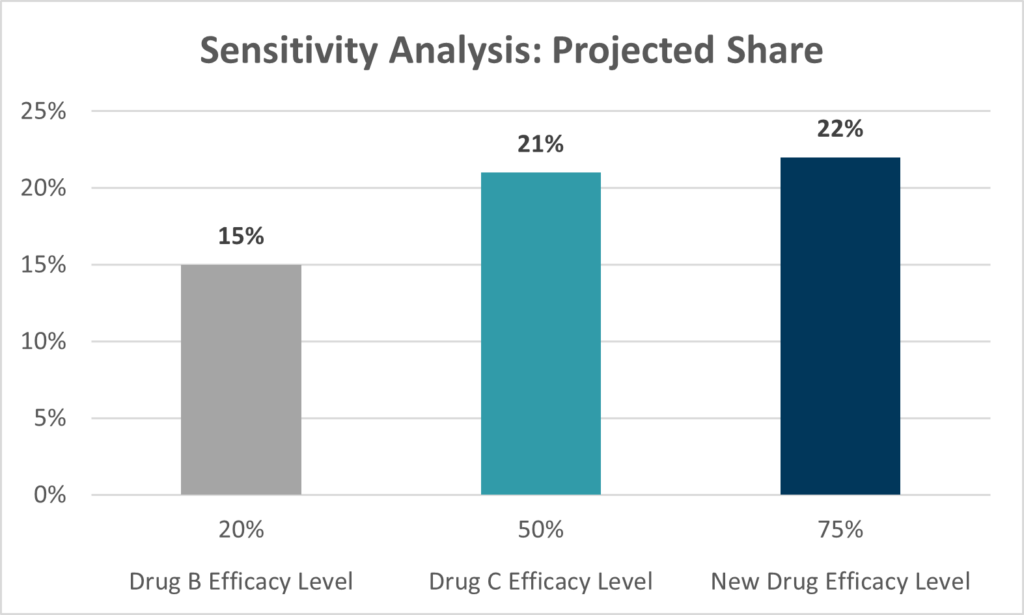

One type of diagnostic, Sensitivity Analysis, combines the importance of an attribute with actual values and so reveals the most advantageous points of emphasis in a marketing campaign. As illustrated in the following chart, the new product’s Efficacy level of 75% provides a major selling point for the New Drug over Competitor B and a minor advantage over Competitor C.

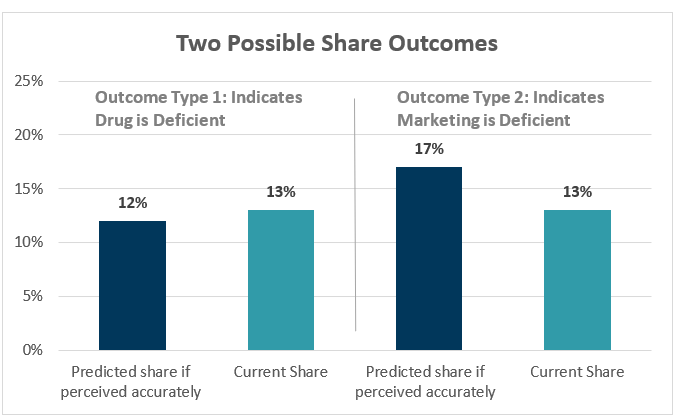

The model also answers the question of whether to change the marketing campaign or the product itself. The model accomplishes this objective by contrasting shares based on perceptions with shares based on actual values. This allows us to predict what would happen in the market if physicians were better informed about the client’s product.

- The result shown in Outcome Type 1 indicates that providing complete and accurate information about the new product would not increase share and suggests that the problem lies with the product itself.

- On the other hand, the results shown in Outcome Type 2 suggests that a new marketing campaign could boost shares if it can make perception match reality.

Conclusion

Discrete choice is commonly used for designing new products, but it is also quite valuable in determining the best approach for rejuvenating older products. The Post-Introduction Modeling variation provides guidance for the best approach in going forward with established products.

In the case of the less than blockbuster drug that gave birth to this approach, the analysis resulted in a conclusion that drug deficiencies were to blame for its low share since physicians placed more importance on side effects than the client had thought. This saved the client from going forward with what might have been a disastrous marketing campaign.